HIGHLIGHTS

- In the third quarter, Apple’s performance in India improved significantly.

- Xiaomi, with a 16.5 percent market share, took second place.

- More than half of the smartphones shipped in the third quarter were 5G models.

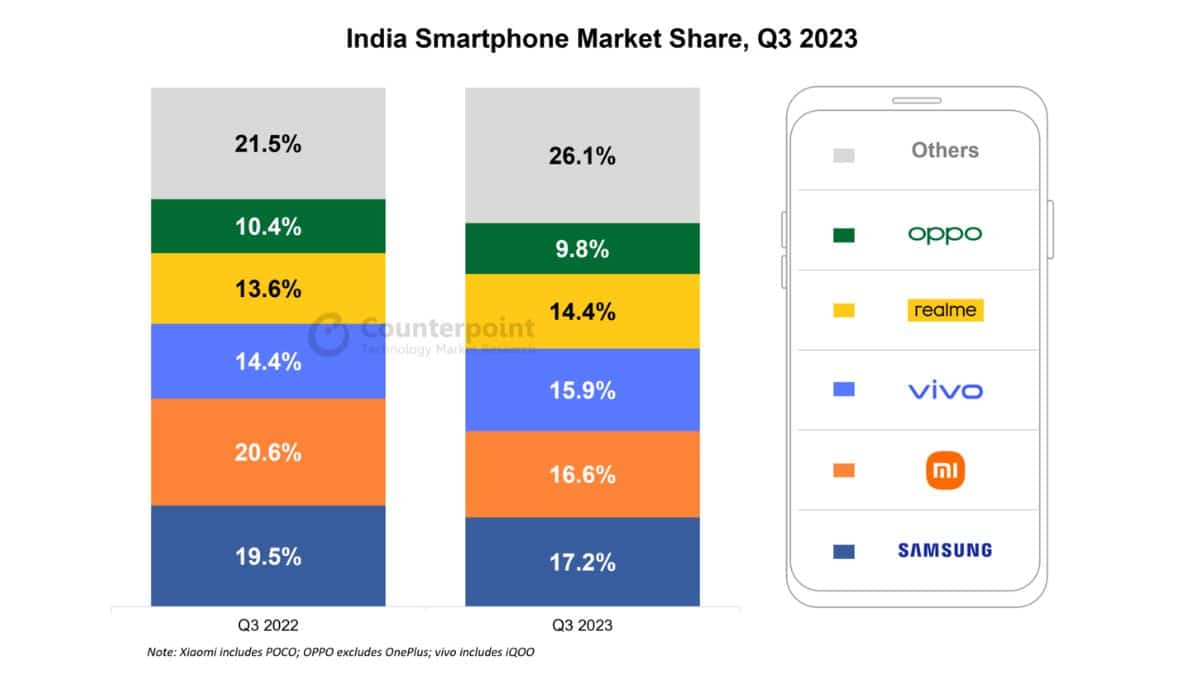

According to a recent estimate, tech giant Apple shipped over 2.5 million iPhones in India during the third quarter of 2023, setting a record for the country. However, for the fourth consecutive quarter, South Korean electronics giant Samsung held a 17.2 percent share, maintaining its top spot in the Indian smartphone market.

Details of Apple iPhone shipments in Q3

- With a 34% boost from the previous year, Apple’s performance in India increased significantly.

- According to a report by Counterpoint Research, Apple shipped more than 2.5 million iPhones during the third quarter of 2023, marking the company’s largest quarterly shipments in the nation.

- According to sources, the iPhone 14, which was released last year, played a role in the record number of shipments for the quarter.

- The survey also stated that Apple profited from the Indian market’s increased desire for high-end handsets.

Xiaomi and Samsung dominate the Indian smartphone industry

- With a 17.2 percent market share in the third quarter of 2023—a little decline from 19.5 percent the year before—Samsung continued to be the leading smartphone brand in India.

- With a 16.5 percent market share, Xiaomi emerged as the runner-up thanks to its offline market development, the success of the Redmi 12 series, and its emphasis on low-cost 5G phones.

- Among the top five brands, Vivo saw the highest increase, rising by 11% year over year to take third place with a 15.9% market share. Strong offline presence, iQOO’s performance in the premium mid-range market, and careful consideration of gadget design were cited as the reasons for this rise.

- With a 41 percent annual growth, transition brands—Tecno, Infinix, and itel—showed the strongest rate of growth.

- In India during the third quarter, the market shares of Nokia, Motorola, Realme, and Google climbed by 31 percent, 27 percent, 7 percent, and 6 percent, respectively.

- With a 29 percent market share, OnePlus led the cheap premium class (between Rs 30,000 and Rs 45,000). The company’s success was largely attributed to the OnePlus 11R’s high sales.

5G smartphones in demand

- 5G smartphones accounted for 53% of smartphone shipments in the third quarter.

- According to the study, there was a notable increase in the price range of Rs 10,000 to Rs 15,000.

- Furthermore, sales of devices in the ultra-premium segment—where prices exceed Rs 45,000—rose by 44% over the prior year, mostly as a result of financing possibilities.