HIGHLIGHTS

- In order to conduct UPI transactions offline, NPCI is currently rolling out UPI Lite X.

- Additionally, UPI Lite X allows Tap and Pay, an NFC-based method for sending money between two phones without an internet connection.

- Exclusively available on the BHIM App, UPI Lite X is shortly anticipated to be made available on various additional payment applications like PhonePe and Paytm.

India handles 40% of all global digital payment transactions. Since its debut in 2016, UPI has grown to become the largest real-time payments system worldwide. As a result of the technology’s acceptance by other governments, five other countries can now use it as well.

UPI Lite, which utilized an on-device wallet system for transactions under Rs 200, was introduced by NPCI last year. UPI Lite was created with the intention of streamlining low-value transactions by eliminating the requirement for the UPI Pin. With Tap And Pay support and the ability to operate without an internet connection, UPI Lite X has already begun to be rolled out by NPCI.

Let’s look at UPI Lite X’s specifications and how to utilize it on a smartphone.

UPI Lite X

The most recent version of UPI Lite is called UPI Lite X. The idea still holds true: the payment app generates an on-device wallet. The user must manually contribute money from the savings account to this wallet. After that, the user won’t need to enter the UPI Pin in order to spend the amount of money on P2M and peer-to-peer transactions up to Rs 500.

To complete the transaction, UPI Lite still required an internet connection. With UPI Lite X, NPCI has at last made it possible to conduct transactions without using the Internet. Additionally, Tap and Pay support has been added to UPI Lite X, enabling the usage of NFC to execute UPI transactions.

The wallet used by UPI Lite X is the same as UPI Lite. As a result, both UPI Lite transactions using QR codes and UPI Lite X transactions utilizing Tap And Pay can be paid for using the funds that the user has put to their UPI Lite wallet.

The UPI Lite X transaction limitations are the same as the UPI Lite limits:

- Maximum Per-Transaction Amount: Rs 500

- Everyday Cap: Rs. 4000.

- 2000 rupees is the maximum permitted wallet balance.

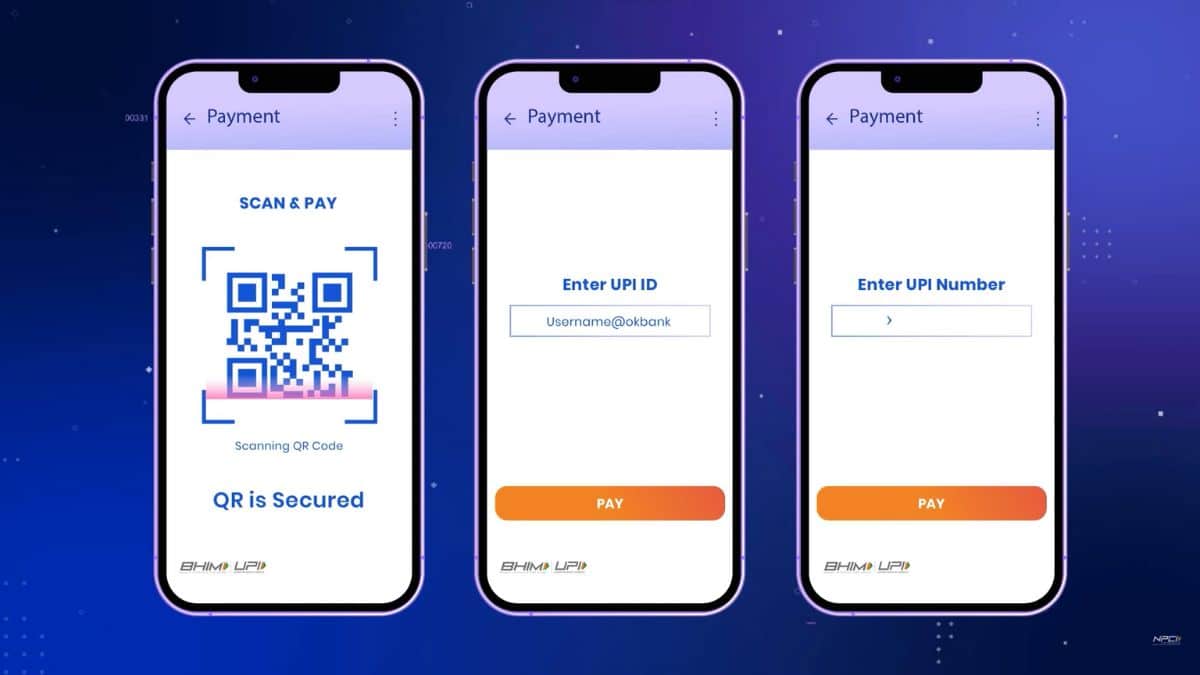

Here is a step-by-step tutorial for using UPI Lite X.

- Tap the ‘Enable’ option in the UPI Lite X Balancing menu after launching the BHIM App.

- To grant consent for offline transactions, toggle the checkbox. Then click “Enable Now.”

- You will now be prompted by the BHIM App to add money to your UPI Lite account. Enter the extra amount you want to add.

- The ‘Enable UPI Lite X’ button must be tapped. Your UPI PIN will be required when prompted.

- You can start utilizing UPI Lite X for Tap and Pay and offline transactions as soon as the money is loaded to your wallet.

Step to Use UPI Lite X for Offline Transactions and Tap and Pay?

On the sender’s and receiver’s devices, UPI Lite X transactions can be carried out offline without the requirement for an internet connection.

- On the Android phones of the sender and the recipient, enable NFC.

- On the sender’s phone, open the BHIM app. The ‘Tap & Pay’ button should be clicked.

- Your desired payment amount should be entered. A unique note for the transaction can also be added.

- Click Confirm.

- On the sender’s smartphone, the BHIM App will now switch to transaction mode. Keep the display active.

- the receiver’s phone’s screen lock should be unlocked.

- Now lightly touch the devices of the transmitter and recipient while bringing them together.

- ‘Device Connected’ will be displayed as a prompt on the sender’s phone. Hold the two gadgets side by side.

- Your UPI Lite X transaction has now been successfully completed.

UPI Lite X’s features

- The wallet used by UPI Lite and UPI Lite X is the same.

- UPI Lite X is available for free; no further fees apply.

- Transactions using UPI Lite X can be carried out offline, without an active internet connection.

- Transactions made using UPI Lite X are not visible in the bank’s passbook.

- For UPI Lite X transactions, entering the UPI PIN is not necessary.

- You can immediately transfer funds received in your UPI Lite X wallets to your savings account.

- In UPI Lite X, Tap and Pay transactions are settled instantly.

Important Information: To ensure that funds are properly received in the recipient’s wallet after an offline UPI Lite X transaction, the recipient must link their device to the internet within 4 days of the transaction.

For UPI payments, NPCI will shortly roll out Tap and Pay QR codes. Here, the QR Code will be placed at the merchant’s end and will contain an NFC chip. The same procedure can be followed by the consumer, who enters the amount in the BHIM App and then completes the sale by bringing their NFC-capable phone up close to the merchant’s NFC QR code.

UPI Lite X transactions can be carried out totally offline, without any internet connectivity, in both P2P and P2M scenarios. The use of UPI Lite X is also possible when the internet is available. The user has the option to scan the QR code manually or utilize Tap and Pay to complete the transaction.

For P2P transactions, funds received via UPI Lite X are kept in the recipient’s UPI Lite wallet. After receiving funds via UPI Lite X, users must manually move the balance that remains from their UPI Lite wallets to their savings account at the bank.