HIGHLIGHTS

- Introduction about the UPI One World.

- In this article, we cover the features and specifications of UPI One World.

- How to use UPI One World.

In the context of the developed digital payments landscape, it is crucial to introduce the Unified Payments Interface (UPI) that has gone international. In India, a UPI which is an instant real-time payment system has profoundly transformed the domestic transactions setting by providing easier and more secure means of payment.

Now, its scope is to work as an international remittance service through which it seeks to allow real-time money transfer and financial access to Indians residing overseas and consumers from various other countries. This article focuses on the effects of the globalization of the UPI, the advantages of utilizing it for users and companies, and the possibilities of the development of e-payments in the conditions of globalization.

Table of Contents

UPI One World

UPI One World is that planned developmental program that intends to take the UPI to the international frontier of operation to provide for easier cross-border transactions. This initiative aims to incorporate UPI’s sound and fast payment platform so that customers can perform international transactions as they do for national ones. UPI One World thus endeavors to integrate the entire world into one payment system and make international transactions more efficient and accessible, thus giving people from different corners of the world easy payments that fit their and the businesses ’ needs. UPI One World has set its goals to transform the foreign digital payment system with the help of the already developed UPI system.

Features of UPI One World

Seamless Cross-Border Transactions:

- The provision of cross-border money transfers helps make international transactions as comfortable and easy as domestic UPI transactions.

Global Interoperability:

- Fits into global banking structures and accepts them to increase usage within banking circles.

Multi-Currency Support:

- Supports operations in various currencies, fitting the requirements of numerous people across the world.

Enhanced Security:

- Needs to support encryption and security measures to ensure that customers’ transactions are safe and encrypted.

User-Friendly Interface:

- It retains the basic non-technical user interface characteristic of the domestic UPI and can be used by users anywhere in the world.

Low Transaction Costs:

- It charges affordable transaction fees thus customers can conduct business transactions at cheaper rates for international money transfers.

Comprehensive Customer Support:

- Offers reliable customer service to offer solutions to users concerning their cross-border transactions as well as any calamities that may occur.

Specifications of UPI One World

Interoperability Standards:

- Adjustable to the payment systems interoperability as it is defined by the financial sphere – which makes the solution universal on the level of the whole world.

API Integration:

- Offers vast API features that enable it to connect the banking and financial applications introduced to other applications worldwide.

Regulatory Compliance:

- Legal and secure to do the transactions by the internationally accepted financial law and regulation.

Currency Conversion:

- Offers ways of performing the arithmetic operations for converting each currency so that certain easier ways of performing transactions in several currencies are realized.

Scalability:

- Created to accommodate many operations, implying that the gadget is trustworthy and therefore, trustworthiness will rise in tandem with usage.

Localization:

- Supports multiple languages and regional preferences to meet all the users around the globe.

Fraud Detection and Prevention:

- Helps with sophisticated and elevated examinations against fraud control as well as protection mechanisms against fraud.

Integration with E-Wallets and Digital Banks:

- Mr Radhakrishnan added that E-Wallets and Digital Banks can also be integrated with the services offered by the App.

- Therefore, compatibility of the solutions with most of the existing e-wallets and other forms of digital banking to enhance the environment of digital payments.

How to use UPI One World

Registration and Setup

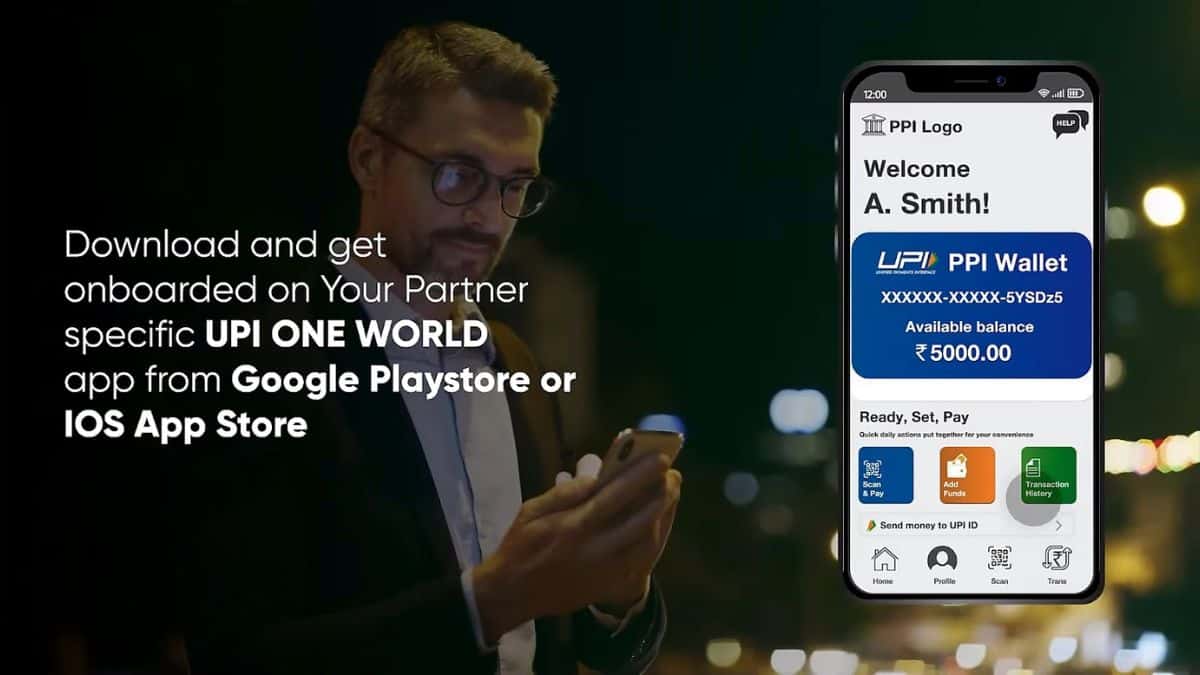

Download a UPI-Compatible App:

- To make the payment through UPI One World, using a different UPI application which is Google Pay, PhonePe, and Paytm download it from the store of the smartphone.

Register and Create an Account:

- Nonetheless, as has already been mentioned, to receive the services and the benefits of other sites, one has to sign up and create an account.

- At the beginning, use the application and enter your telephone number as the registration details. The procedure to be followed is to make account creation only for the respective mobile numbers by using the on-screen instructions.

- This Mobile number should tally, and this should be acknowledged from an OTP (One-Time Password).

Link Your Bank Account:

- In the application go to the link bank account tab.

- Choose the bank under which you are operating out of the list of the numerous banks that are recognized by the money transfer service.

- Following this, you have to enter your bank details/Account number in the provided space and then enter the Time Password received from the bank.

Can you give some ideas on how to set up a one-world unit through UPI?

Enable International Transactions:

- Play in the settings or UPI One World tab of the application you are employing.

- Cross payment borders by ensuring you follow the special instructions that the application lays out to be followed. When answering some of the questions, you will be required to give additional information or attach a document to support your response.

Set UPI PIN:

Check if you have set a PIN or if it has been set previously, and in that case, Reset your UPI PIN. Several transactions will be authorized with the aid of this specific PIN.

Making a Transaction

Initiate a Transaction:

- Log on to the application and select the option that will read either Send Money or Transfer.

- Go to the option that says international transfer or something like that.

Enter Recipient Details:

- Fill in the recipient details as their UPI ID, bank account number, or any other details that have been asked to be entered.

- Make sure that you and the person with whom you want to transact have enrolled in the UPI One World-enabled app.

Enter Amount and Currency:

- Provide the amount you want to send and depending on the country you want the currency to be converted to, select that option.

- For the translation, it will use current exchange rates to ensure the correct conversion when displaying it in the different currencies of the client.

Review and Confirm:

- Check the sender’s information as well as the receiver and the amount of money to be transferred as well as any charges that will be incurred.

- If the received amount is correct, then, confirm the transaction, and authorize it by entering the UPI PIN.

Receiving Money

Share Your UPI ID:

- Remit your UPI ID to the sender.

- Make sure that the UPI ID is connected to a bank account that allows cross-border transactions to be received.

Notification and Confirmation:

- You will receive a notification on your app once the money is sent.

- Ensure that you get the cash by checking your balance in the app or the balance in your bank account.

Managing Transactions

Transaction History:

- Go to the app and there is a provision where you can tap to see your past transactions.

- Verify individual transactions by date, their amount, and the recipient of the amount.

Support and Assistance:

- For any difficulties or questions regarding the UPI One World transactions, it is advisable to make use of the customer support option in the application.

- If any further assistance or information is required you can call the executives of your bank.

Conclusion:

The worldwide growth of the Unified Payments Interface (UPI) is changing the landscape of digital payments. UPI Global Reach wants to make instant cross-border transactions easier by taking its smooth, safe, and quick platform outside India. This plan gives people and companies a trustworthy and cheap way to pay, and it helps link up the world’s economy. As UPI keeps growing and joining with money systems around the world, it could spark big changes in how people everywhere handle digital payments. This might lead to a future where money can move across borders.

FAQs

How does UPI work across borders?

Turn on UPI International Look at the QR code from the overseas seller. Type in the amount you need to pay in the foreign money. Pick which bank account you want to use to pay the overseas seller. The money comes out of this bank account in Indian rupees.

What’s the highest amount you can send through UPI?

The top SBI UPI transfer limit is Rs.1,00,000. But you can’t raise this limit above Rs.1,00,000. Bank officials have put this cap on UPI transfers.