HIGHLIGHTS

- Introduction about the UPI.

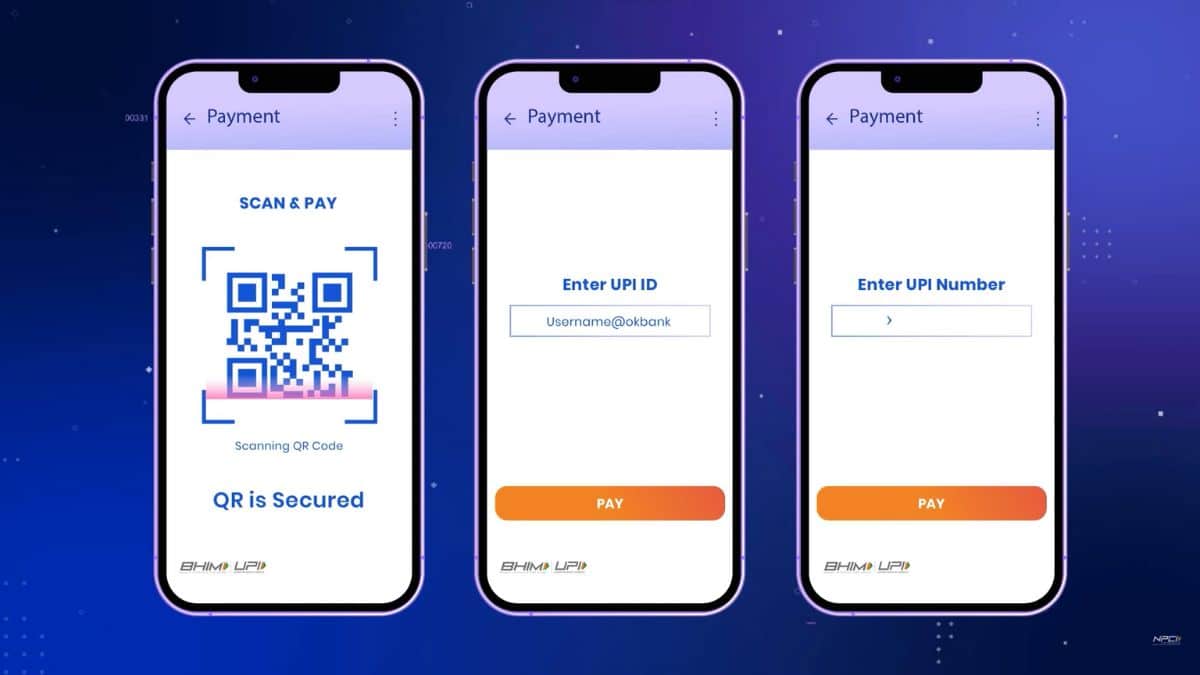

- In this article, we discuss some UPI security concerns.

- Best UPI Transaction Apps in 2024.

In the time of modern world, we are all aware of online transactions through UPI and their uses in daily life purpose. The UPI apps like Google Pay, Phone Pay, Paytm, Amazon Pay, etc are familiar apps for transactions in India. Like any financial tech, UPI brings its security issues that users and stakeholders should keep in mind. In this article, we cover security issues related to UPI.

Table of Contents

UPI (Unified Payments Interface)

The Unified Payments Interface (UPI) technology unifies various banking functions, smooth fund routing, and merchant payments under one roof by enabling numerous bank accounts into a single mobile application (of any participating bank). Additionally, it supports “Peer to Peer” collection requests, which can be planned and funded according to convenience and necessity.

With the above context in mind, NPCI conducted a pilot launch with 21 member banks. The pilot launch was on 11th April 2016 by Dr. Raghuram G Rajan, Governor, RBI at Mumbai. Banks have started to upload their UPI-enabled Apps on Google Play store from 25th August 2016 onwards.

UPI Security Concerns

Phishing Attacks:

Phishing implies deceiving users with lying messages or websites that pose as genuine bodies to obtain their UPI credentials.

Users need to authenticate the legitimacy of messages and avoid opening suspicious links. It is also crucial to use trusted apps and sites only.

SIM Swap Fraud:

In case of sim swap fraud, cybercriminals can use this opportunity to get a duplicate SIM card, intercept one-time passwords (OTPs) sent to the user, and perform unauthorized transactions.

The user should promptly report any suspicious activity on his/her SIM card and think about using multi-factor authentication.

Malware Attacks:

Cybercriminals can install malicious software onto the user’s device thus capturing sensitive information such as UPI PINs and account details.

This risk can be mitigated through such measures as regularly updating software, utilizing bona fide antivirus programs, and shunning downloads from unknown sources.

Social Engineering:

Scammers pretend as trusted entities to manipulate users into giving away their UPI credentials or initiate financial transactions without authorization.

Individuals must be cautious when it comes to sharing personal information with strangers and confirm who they are before sharing financial information with them.

Weak UPI PINs:

Attackers often take advantage of predictable UPI PINs hence attackers can access your account.

Consumers must develop strong, different PINs and update them frequently.

Phony UPI Apps:

Fraudulent UPI apps can imitate genuine ones, capturing user data and cash.

Users should install applications exclusively from authorized app stores as well as confirm the genuineness of these apps by reviewing developer details and user ratings.

User Ignorance:

Type of Threat: Most users have no idea about security procedures and threats associated with UPI.

Continuous awareness campaigns and training for users are needed to identify possible scams before they occur.

Types of UPI scams

QR Code Scams:

It is the first on the list among various methods fraudsters employ to cheat people. A case in point is QR code spoofing in which monetary transfers occur between the scammer’s and victim’s account. An instance is also the receipt of the profits from the victim.

OTP Theft:

These are the people the scammers target to extract the OTPs from, which they make them do for conducting unapproved transactions.

Call Spoofing:

Scammers are clever in that they can correctly impersonate a bank’s officer and, by doing so, cause the consumer to exchange sleeping arrangements for the protection of their UPI PIN.

Fake Customer Support:

It is a way of robbing people of their money. That is, they pretend to be a service provider, taking the customer’s information that is needed with the usurpation of a UPI number.

Vishing:

It is the abbreviated form of Voice Phishing for which the last technology, i.e. phone calls, has been the main operational tool for scammers. They will sound like they come from famous service providers, and banks.

Unauthorized Payment Requests:

The scammers send the users wrong payments in the name of refunded or genuine transactions. As a result, the users approve these payments. The scammers tap into the communication between the user and the UPI server, and they obtain

Best UPI Apps for Transactions in 2024

- Phone Pay

- Google Pay

- Paytm

- CRED

- Axis Bank App

- Amazon Pay

- ICICI Bank App

- HDFC Bank App

- BHIM UPI

Conclusion:

Today’s generation is becoming smart with smart devices and applications. Transactions become possible fast through online UPI apps from anywhere at any time. Here are some securities issues with UPI transactions and we all have to be aware of these issues listed in this article.

FAQs

What happens if I enter the wrong UPI-PIN during a transaction?

In case you enter the wrong UPI PIN, the transaction will fail. In case you input the wrong UPI PIN multiple times, the bank may temporarily block sending money using UPI from my account (this varies from bank to bank).

Do money transfers happen on UPI only during banking hours?

All payments are instant and 24/7, regardless of your bank’s working hours.